Hence, it is imperative that an individual seeks professional advice to get their finances in order.

What is a Financial Plan

A Financial Plan is a personalised detailed document, which helps the client to identify what their current financial condition is, where they would like to go and help planning and bridging the gaps if any, for helping the client meet their future goals.

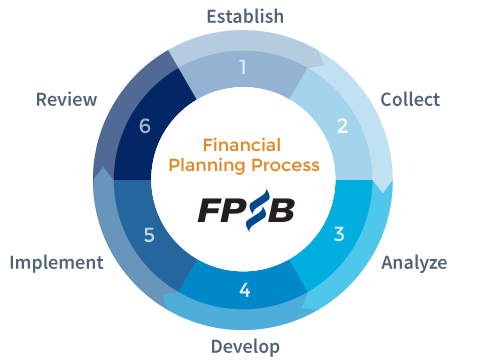

Financial Plan Process

Hence, it is imperative that an individual seeks professional advice to get their finances in order.

What is a Financial Plan

A Financial Plan is a personalised detailed document, which helps the client to identify what their current financial condition is, where they would like to go and help planning and bridging the gaps if any, for helping the client meet their future goals.

Financial Plan Process The Financial plan process starts from identifying the objective, needs and scope of engagement with clients. Data gathering is the first and most important step towards identifying one’s current financial condition. It is the most important step, because the data provided by the individual, should be accurate and up-to-date, for the planning process to be effective and meaningful.

This process involves gathering data of all aspects of finance of a client such as

The Financial plan process starts from identifying the objective, needs and scope of engagement with clients. Data gathering is the first and most important step towards identifying one’s current financial condition. It is the most important step, because the data provided by the individual, should be accurate and up-to-date, for the planning process to be effective and meaningful.

This process involves gathering data of all aspects of finance of a client such as

FPG India ©2024. All Rights Reserved.

Designed & Developed by W3M Technoz